Average deductions from paycheck

The average marginal tax rate is 259 while the average tax rate is 169 as stated above. In each paycheck 62 will be withheld for Social Security taxes 62 percent of 1000 and 1450 for Medicare 145 percent of 1000.

Different Types Of Payroll Deductions Gusto

Additionally the FICA and State Insurance Taxes would take away 790 for a tax deduction.

. Find Fresh Content Updated Daily For Standard payroll deductions. The standard deduction dollar amount is 12950 for single households and 25900 for married couples filing jointly for the tax year 2022. These percentages are deducted from an employees gross pay for each paycheck.

Tax or National Insurance. However they dont include all taxes related to payroll. Understanding paycheck deductions What you earn based on your wages or salary is called your gross income.

You need to save 5 of every paycheck if you start at age 25. You need to save 10 if you start at age 35 22 if you start at age 45 and 52 of every paycheck if you start. For example an employee with a.

You pay the tax on only the first 147000 of your. Taxpayers can choose either itemized deductions or. Deductions from your pay.

How Much Tax Is Deducted From A 1000 Paycheck. What Percent of Taxes Is Deducted From My Paycheck. Ad Compare Prices Find the Best Rates for Payroll Services.

Social Security tax and Medicare tax are two federal taxes deducted from your paycheck. You need to save 10 if you start at age 35 22 if you start at age 45. Employers withhold or deduct some of their employees pay in order to cover.

The result is that the FICA taxes you pay are. FICA taxes are commonly called the payroll tax. Description Sub-amounts Amounts 27 Total federal and provincial tax deductions for the year line 13 plus.

Something youve done and your contract says youre liable for it for example a shortfall in your till if you work in a shop. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. FICA taxes consist of Social Security and Medicare taxes.

Make Your Payroll Effortless and Focus on What really Matters. Payroll deductions are wages withheld from an employees total earnings for the purpose of paying taxes garnishments and benefits like health insurance. Calculate total tax and the tax deduction for the pay period.

Depending on the state where the. Luckily when you file your taxes there is a deduction that allows you to deduct the half of the FICA taxes that your employer would typically pay. Understanding paycheck deductions What you earn based on your wages or salary is called your gross income.

Pin On Innes Tax Resources

Saltmoney Org Scholarship Infographic Https Www Saltmoney Org Content Media Infographic Are Schol Scholarships For College Scholarships School Scholarship

Get More Money On Your Paycheck Now 12 2020 Youtube Tax Deductions Savings Account Budget Planner

Understanding Your Paycheck Credit Com

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

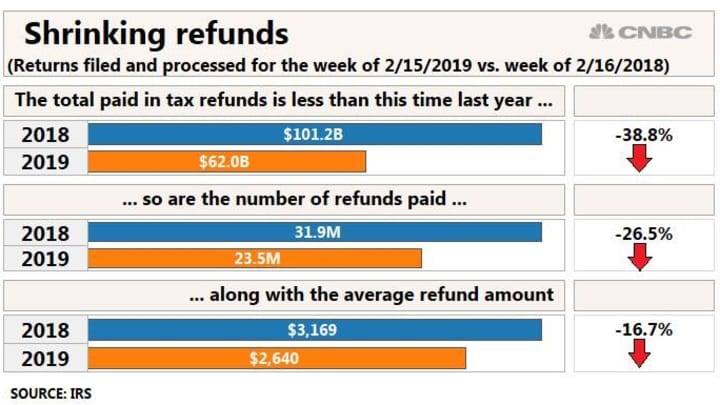

Here S Why The Average Tax Refund Check Is Down 16 From Last Year

Why I Use The 50 30 20 Formula Budgeting Money Saving Money Budgeting

Only One Out Of Three Americans Actually Knows What Their Monthly Budget Is Why Is This Important If You Always Worry Spending Money Spending Habits Spending

Mary Kay Marketing Plan Sheet Perfect For Team Building Opportunities Find It Only At Www Thepinkbubble Mary Kay Marketing Mary Kay Business Selling Mary Kay

Report Teachers Will Spend An Average Of Over 820 Of Their Own Money On Classroom Supplies This Year They Can Only Deduct 300 Of It R Dataisbeautiful

4 Ways To Calculate Annual Salary Wikihow

Average Project Manager Salaries By Country Title 2020 Salary Guide Management Project Management

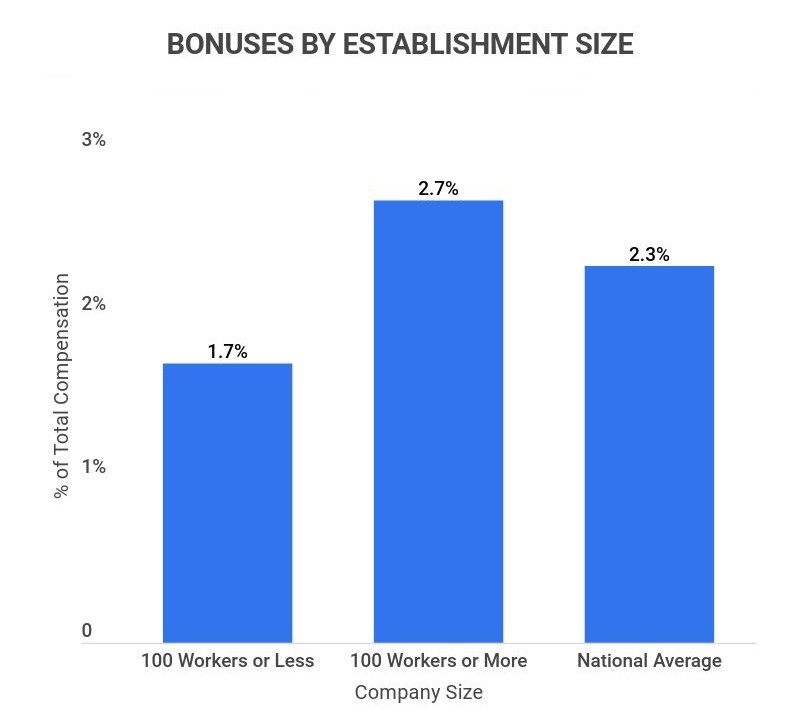

What Is The Average Bonus Percentage 2022 29 Facts And Statistics About Bonuses Zippia

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Pin On Free Salary Slip Template

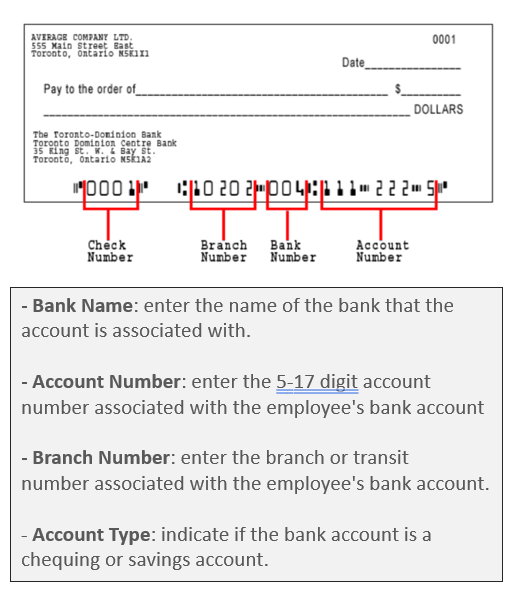

Everything You Need To Know About Running Payroll In Canada

4 Ways To Calculate Annual Salary Wikihow