Depreciation recapture calculator rental property

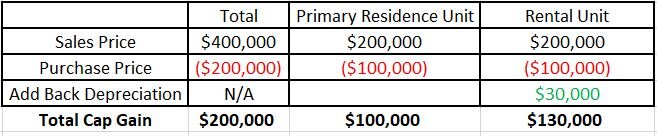

Remaining profits from the sale of a rental property are taxed at the capital gains tax rate. Put another way depreciation.

3 Ways To Avoid Depreciation Recapture Tax On Rental Property The Darwinian Doctor

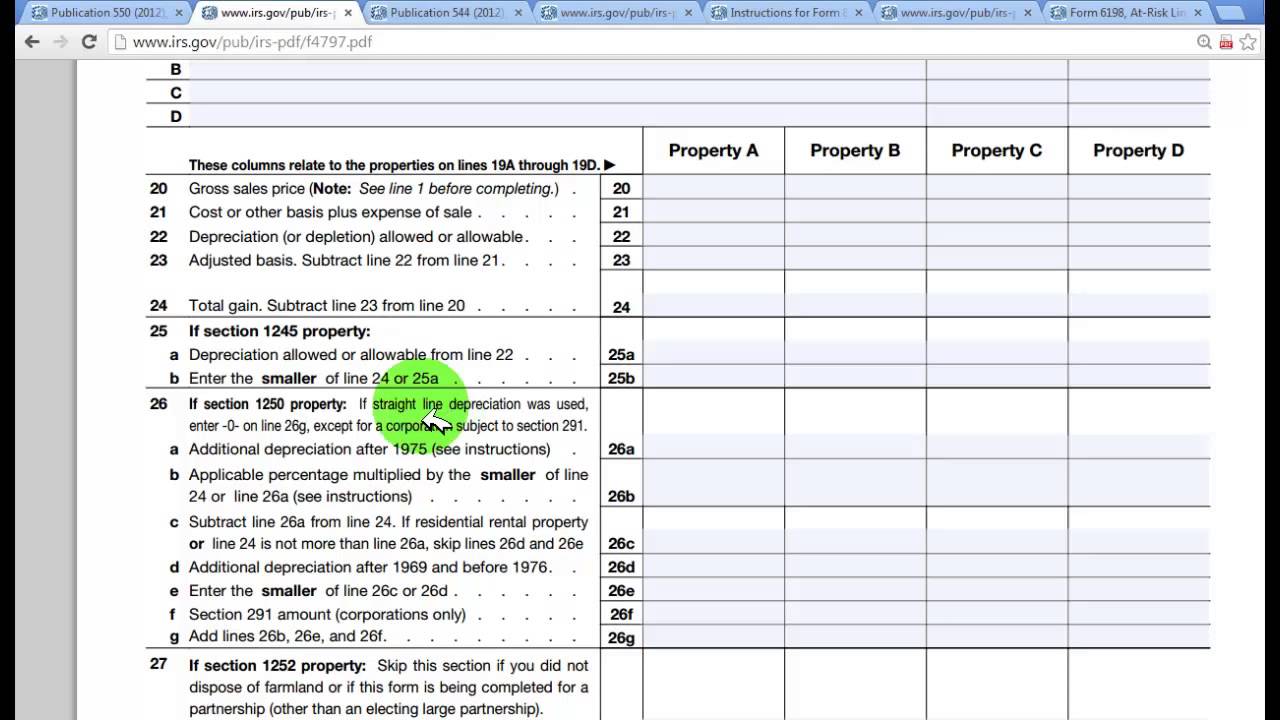

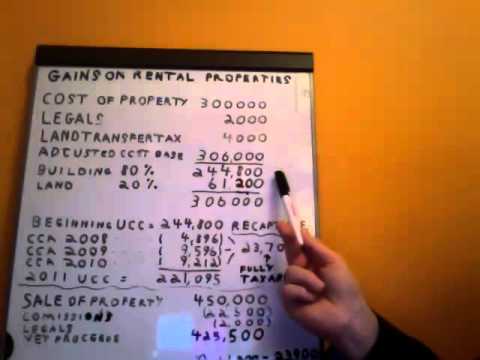

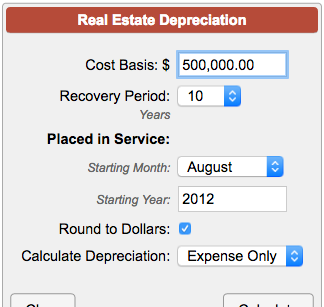

The calculation involves the following steps.

. Divide Cost by Lifespan of Property. It allows them to deduct the cost of their property along with. Your depreciation recapture gain is 102560.

Ad With Decades Of Experience Let Cornerstone Help With Securitized 1031 Replacement Today. Property 3 days ago 5 Okay subtract the total depreciation expense calculated in Step 2 from the total gain to compute. Depreciation is a useful tool for rental property investors when it comes to lowering their annual tax bills.

Depreciation recapture is taxed at an investors ordinary income tax rate up to a maximum of 25. Depreciation recapture is a provision that allows the IRS to collect taxes - at the point of selling the property - using the depreciated cost-basis. Depreciation recapture is assessed when the sale.

- Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and. Reduce Your Income Taxes - Request Your Free Quote - Call Today. Rental property is subjected to depreciation and the rental.

Our Premium Calculator Includes. Our Premium Calculator Includes. How to Calculate Depreciation Recapture.

Your initial cost basis would look like this. Ad Get a Free No Obligation Cost Segregation Analysis Today. In this instance your capital gain on the property is 152560 102560 50000.

6 Multiply your capital gain by the capital gains. Cornerstone Combines The Power Of 1031 Securitized Real Estate. How do I calculate depreciation recapture.

In this step you take your cost basis from step one and divide it by the years that your rental property is considered to have a useful life. Calculate adjusted cost basis. Ad Get a Free No Obligation Cost Segregation Analysis Today.

- Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and. Depreciation recapture is the gain received from the sale of depreciable capital property that must be reported as income. Reduce Your Income Taxes - Request Your Free Quote - Call Today.

Purchase price land value improvements closing costs 200000 - 40000 50000 10000 220000.

Rental Property Depreciation Calculator Cheap Sale 60 Off Www Barribarcelona Com

Tax Treatment Of Sale Of Rental Property Youtube

Capital Gains Recapture On Disposition Of A Rental Property Youtube

Converting A Residence To Rental Property

How To Calculate Depreciation On Rental Property

Rental Property Depreciation Rules Schedule Recapture

Rental Property Depreciation Rules Schedule Recapture

Rental Property Depreciation Calculator Cheap Sale 60 Off Www Barribarcelona Com

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Do I Have To Pay Tax When I Sell My House Greenbush Financial Group

How To Fill Out Schedule E Rental Property On Your Tax Return Youtube

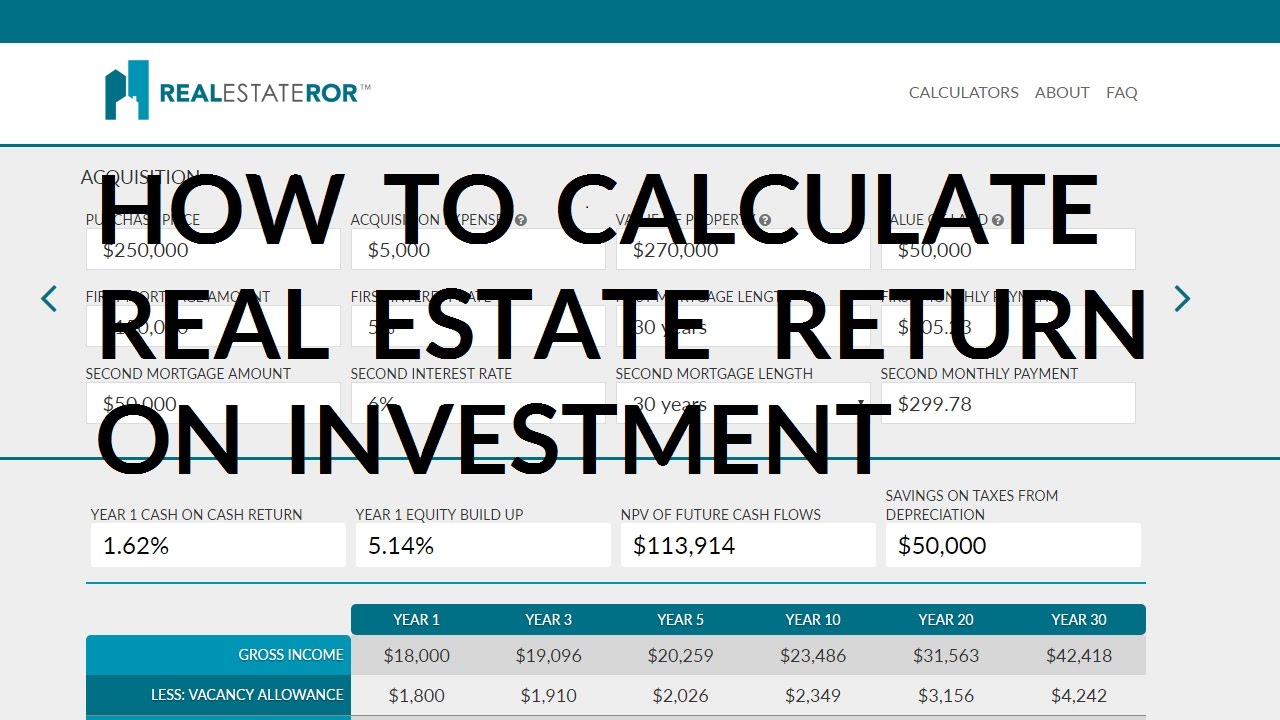

How Do You Calculate Return On Investment On Rental Property

Understanding Rental Property Depreciation 2022 Bungalow

What Is Rental Property Depreciation And How Does It Work

Depreciation Recapture What Is It And How Can I Reduce It

Rental Property Depreciation Calculator Cheap Sale 60 Off Www Barribarcelona Com

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com